List of Fintechs Offering To Help Nigerians Make Foreign Payments As Banks Suspend Dollar Use on Nai

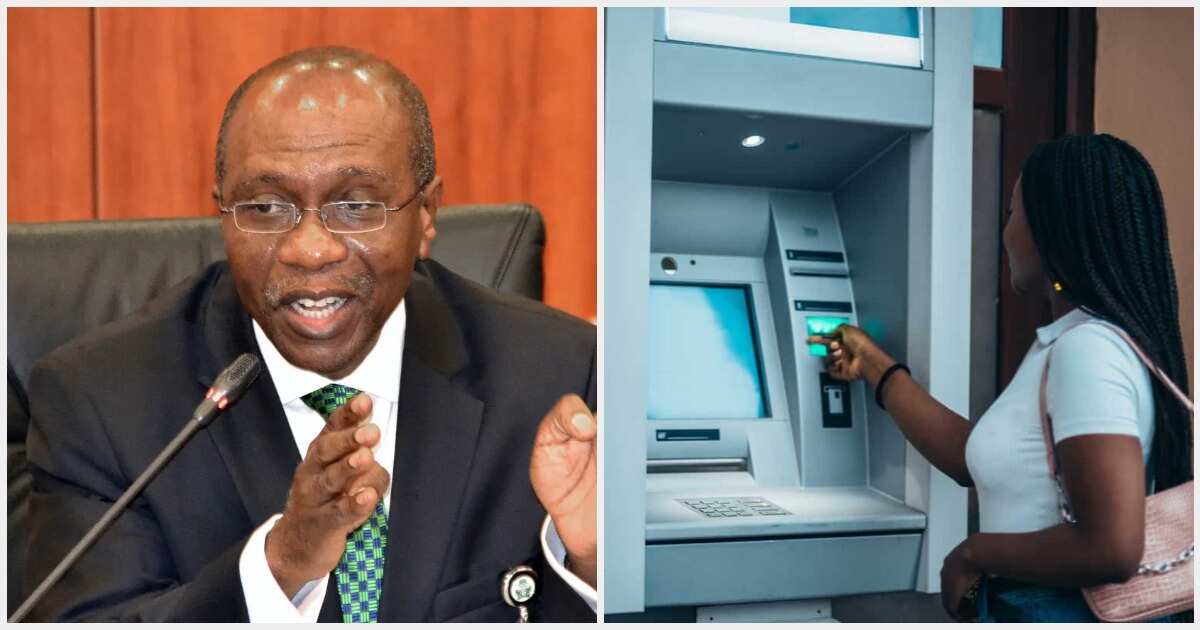

- Nigerian major banks have announced the suspension of international transactions on naira card

- The move is amid a shortage of foreign exchange in the country and the high demand for dollar

- However, fintech companies have taken up the opportunity to offer solutions to Nigerians looking to make foreign payments

There is an opportunity lurking in every issue, and this is precisely what Nigerian fintech companies are doing.

While commercial banks are announcing the suspension of international transactions on naira debit cards, the fintech companies are offering alternatives.

Legit.ng had earlier reported that Zenith Bank informed its customers that it would be suspending international ATM withdrawals, web transactions, and PoS transactions conducted with its naira card.

Zenith Bank's decision makes it one of the long list of Nigerian banks that have either reduced or closed their foreign transactions on naira cards.

Read also

We're not hiring: E-Commerce firm raises alarm over fake job offers in Nigeria

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

The development opens up a new variety of payment options, notably virtual dollar cards, for Nigerians who need to pay for international transactions.

It is crucial to highlight, however, that Nigerians considering using any of the fintech services listed must first conduct thorough research.

List of fintech companies offering dollar card alternatives

Payday

Payday offers virtual accounts in nations like as the United Kingdom and the United States.

Verified users may also construct a virtual dollar Mastercard that allows them to make up to $25,000 in monthly transactions.

Changera

Changera customers may utilize the virtual dollar card to make online payments. Money transfers, currency conversion, and a virtual bank account are also available.

Chipper Cash

Chipper Cash offers a virtual Visa card that customers may use to make purchases on platforms like Amazon or to pay for foreign subscriptions.

Read also

Banks Suspend Transactions via Naira Credit, Prepaid Cards as CBN’s Domestic Card Scheme Kicks Off

Geegpay

Geegpay provides a virtual dollar card for $2 to users who live in Nigeria but work with foreign companies.

Payoneer

This is another company similar to Geepay. It offers users a virtual dollar card to make payment dollar or any other foreign currency payments online.

Nigerian couple breakdown how much spent relocating to UK

Meanwhile, in another report, a Nigerian couple who recently secured relocation to the United Kingdom has published what it cost to make the move.

The comprehensive estimate provided insight from visa application to settling down in the first nine months.

The number of Nigerians leaving for the UK is at an all-time high, particularly via studies.

Source: Legit.ng

ncG1vNJzZmivp6x7rbHGoqtnppdkr7a%2FyKecrKtdmrCwus6msGislZi1r7vLqJ6yZ2FqfnWClmpkpaGjqXqntc2tnJygXaSzp7HRoqWgZZ6etKa%2ByJqlrGWWpL%2BmtcanZKmZqaKyr8DSZpmappuoerTB0qmcp5xdmbytuMCrZKeZmaeubq%2FAq5to